2023 年 5 月 25 日,用友新加坡举办了 FICC 投资解决方案研讨会,邀请行业投资专家和客户围绕 FICC 投资解决方案展开深入讨论。研讨会旨在探索新的行业机遇,并更好地支持投资与资产管理的数字化转型。

【新加坡用友董事总经理 Howard Chen 的开幕致辞】

会议伊始,用友新加坡董事总经理 Howard Chen 对来自行业的产品及投资专家表示热烈欢迎。他强调了本次研讨会对产品创新和行业发展的重要意义,并希望与会者能够借此宝贵机会相互交流见解,针对用友投资解决方案的应用提供反馈和建议,共同推动 FICC 投资解决方案在资产管理领域的发展与应用。

用友团队首先介绍了公司的发展历程,重点展示了用友新加坡在东南亚市场取得的重要成就和合作成果。作为领先的投资与会计解决方案提供商,用友在银行、保险及资产管理等优势行业取得了丰硕成果。

【用友全球资金解决方案中心副总裁 Elle Lu】

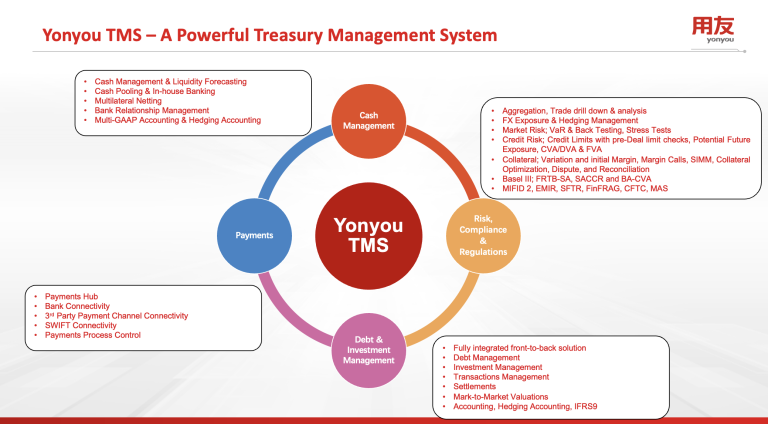

随后,用友全球财资解决方案中心副总裁 Elle Lu 详细介绍了面向企业和金融机构的 FICC 财资管理系统(TMS)及投资管理系统(IMS)。她通过多个关键案例,展示了 FICC 系统在不同企业场景中的实际应用,包括单体企业、跨国公司及家族办公室,并深入讲解了该系统在风险管理和投资账户管理方面的实际应用。

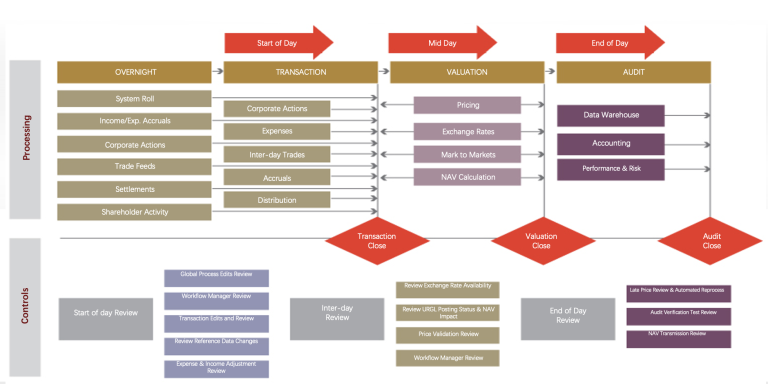

用友 FICC 投资解决方案为企业提供全面且灵活的功能,支持实时管理头寸、现金及证券库存,并覆盖各类资产的风险管理。财资管理系统(TMS)集成强大的现金流管理、债务与投资管理、风险控制等功能。投资管理系统(IMS)通过整合前台、中台和后台的资产管理流程,助力优化投资组合,实现稳定增长。

在接下来的环节中,FICC 项目顾问 Lucy Lv 重点介绍了 FICC 系统的功能及应用,详细讲解了其在整个业务流程中为企业提供的支持与服务。通过 Lucy 的分享,与会者对 FICC 如何促进企业发展和增长有了更深入的了解。

在问答与交流环节,与会者结合自身企业的发展需求,与产品专家展开了积极讨论。用友借此机会聆听客户反馈,旨在为企业提供更安全、更易用、更全面的资产管理系统,提高管理效率。

此外,本次研讨会为投资领域的企业搭建了一个宝贵的合作平台,助力企业抓住数字化转型机遇,更灵活地应对经济风险和市场波动环境,迈向智能化资产管理的新阶段。